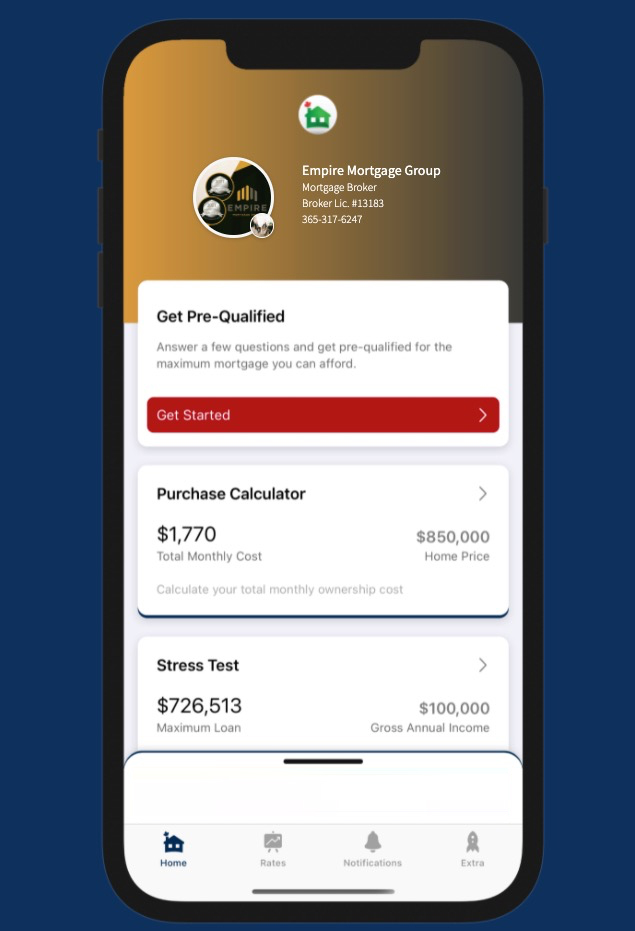

First-time Homebuyers

Buying your first home is exciting and nerve-racking as there are many steps to work through. Since this is one of your biggest purchases, working with an experienced mortgage professional to help navigate from pre-approval to closing is essential. An experienced mortgage professional will help explain and go through options that are available to first time buyers, which can be several. In addition, we will ensure that you are able to take advantage of the most competitive terms that are customized to your needs.